Online Accounting – The Digital Age Finance Revolution

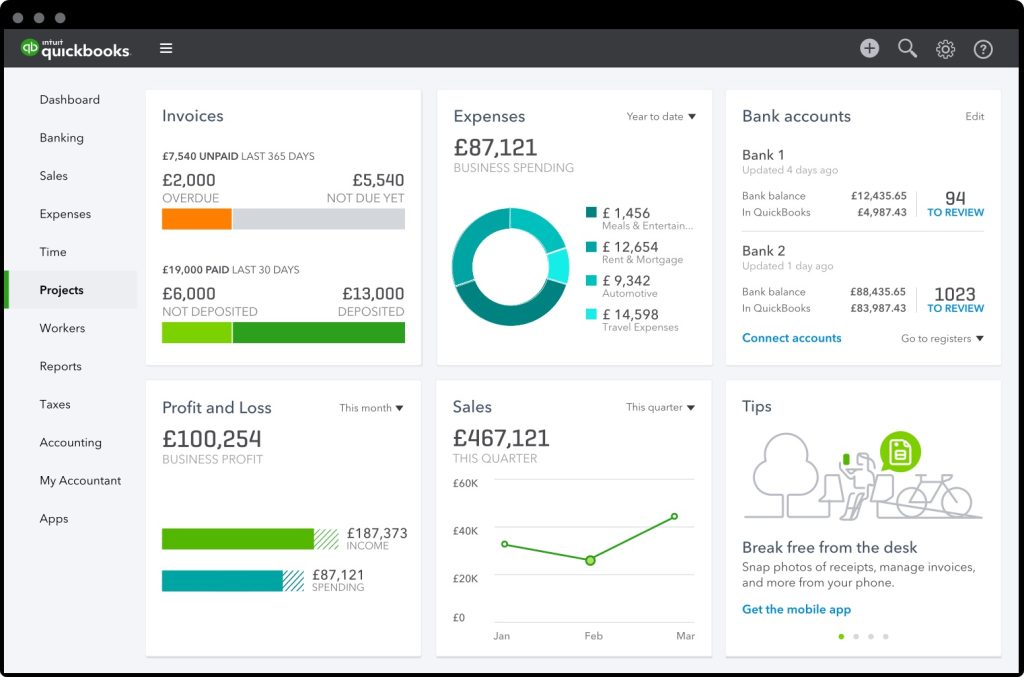

The Digital Age has ushered in a profound transformation in the world of finance, and at the forefront of this revolution is online accounting. Gone are the days of traditional, paper-based bookkeeping and manual data entry; in their place, we now have efficient, accessible, and highly adaptable online accounting solutions. These digital tools have not only streamlined financial processes but have also democratized access to accounting services, leveling the playing field for businesses of all sizes. One of the most significant advantages of online accounting is its accessibility. Cloud-based accounting software has made it possible for individuals and businesses to access their financial data from anywhere with an internet connection. This means that accountants can work remotely, collaborating seamlessly with clients, and business owners can monitor their finances on the go. No longer bound by the limitations of desktop software or physical paperwork, the digital age has given us the freedom to manage our finances from virtually anywhere, promoting efficiency and flexibility.

Moreover, the accuracy and precision of online accounting tools have dramatically improved the reliability of financial data. Automation features such as bank feed integration, automated transaction categorization, and real-time data updates reduce the margin for human error, ensuring that financial statements and reports are more accurate than ever. This not only saves time but also minimizes the risk of costly mistakes that can plague traditional manual bookkeeping. In the digital age, security has become a paramount concern, and online accounting software is well-equipped to address this issue. Data encryption, multi-factor authentication, and regular software updates help safeguard sensitive financial information from cyber threats. The cloud-based nature of these systems also ensures that data is backed up and protected against physical disasters, providing peace of mind to business owners and accountants alike. Another pivotal aspect of online accounting is its potential for real-time collaboration Click Here. With features like shared access, multiple users can work on the same financial data simultaneously, facilitating collaboration between accountants and their clients.

This collaboration fosters better communication and transparency, which is essential for making informed financial decisions and ensuring compliance with tax regulations. Furthermore, the scalability of online accounting tools allows businesses to adapt and grow without the need for extensive software upgrades or investments in additional hardware. As companies expand, they can easily adjust their accounting software to meet their evolving needs, whether it is managing a larger volume of transactions, handling multiple currencies, or complying with more complex tax regulations. In summary, online accounting is a game-changer in the finance industry, revolutionizing the way we manage and understand our financial data. Its accessibility, accuracy, security, and collaborative features have democratized accounting services, making them available to businesses of all sizes. In a world where financial data is critical to success, online accounting empowers individuals and organizations to navigate the complexities of modern finance with ease and confidence, driving efficiency and financial well-being in the Digital Age.